Excess and Surplus Insurance: A Complete Guide for Independent Agents (2026)

If you’re an independent insurance agent staring at a “declined” file on your desk, you already know the frustration of a hard market. Standard carriers have limits – underwriting guidelines, risk appetites, or past loss histories can leave your clients without coverage. That’s where Excess and Surplus (E&S) insurance comes in.

Think of it as the safety valve of the insurance industry – a strategic tool that allows you to protect high-risk or unique clients, maintain relationships, and grow your business even when standard markets say “no.”

This article will walk you through which risks may qualify, compliance requirements like the diligent search, and how to access the E&S marketplace efficiently. By the end, you’ll have the tools to save deals, retain clients, and expand your book of business.

- E&S insurance covers high-risk or hard-to-place clients such as cannabis businesses and construction risks that standard lines carriers won’t insure due to underwriting guidelines, loss history, or capacity limits.

- A “diligent search” of the admitted market is often needed before using E&S, but this is not always required now. States like Louisiana, Mississippi, Virginia, Wisconsin, and Florida have dropped this rule. Still, many wholesalers, carriers, or MGAs may ask for proof of a search as part of their process.

- Excess and surplus (E&S) policies are issued by non-admitted carriers that are not rate-and-form regulated, though they remain subject to state surplus lines laws. This flexibility allows broader coverage options but comes without protection from state guaranty funds.

- Getting access to the market is still a big challenge for independent agents, especially those without direct appointments or much business.

- Digital agency aggregator platforms like FirstConnect simplify access by allowing agents to quote E&S policies (select carriers and book of business) without appointment delays.

Independent Agents?

Accelerate Your Agency’s Success

What Is Excess and Surplus (E&S) Insurance?

Excess and Surplus insurance is a specialty market for risks that the standard market either cannot or will not cover. It provides coverage for clients with unusual or high-risk exposures, adverse loss histories, or unique business operations.

In essence, it acts as a safety valve in the insurance sector: when the standard market can’t absorb a risk, E&S insurance steps in to ensure protection.

These policies are written by non-admitted carriers, meaning they are not required to file rates or forms with the state. This flexibility allows them to tailor coverage to unique client needs, making E&S an essential tool for independent agents seeking to retain clients in challenging markets.

Admitted vs. Non-Admitted Insurance: What Agents Need to Know

Admitted carriers are licensed by the state’s insurance department and must file policy forms and rates for approval.

Non-admitted insurance, which includes excess and surplus lines, operates differently. These carriers are not required to file rates or forms, giving them freedom of rate and form to price risk accurately and customize coverage.

The most important distinction for clients is state guaranty fund protection. Admitted policies are backed by the state guaranty fund if an insurer becomes insolvent. Non-admitted carriers are not, meaning policyholders rely on the carrier’s financial strength rather than state protection.

Because of this, many surplus lines insurers maintain strong solvency/A.M. Best ratings and are often affiliated with large, established insurance groups, including markets like Lloyd’s of London.

Here is a table that shows the main differences:

| Feature | Admitted Carrier | Non-Admitted Carrier |

| Regulation | State regulated | Not subject to state rate-and-form regulation; governed under surplus lines statutes |

| Guaranty Fund Protection | Yes | No |

| Pricing Flexibility | Uses standard filed rates and forms | Freedom of rate and form for flexible pricing |

| Taxes | Standard premium tax | Surplus lines tax may apply |

| Typical Risk Profile | Common or standard risks | High-risk or unique exposures |

Independent agents should clearly explain these trade-offs, including surplus lines taxes and the lack of guaranty fund protection, so clients understand where and how their policy is placed.

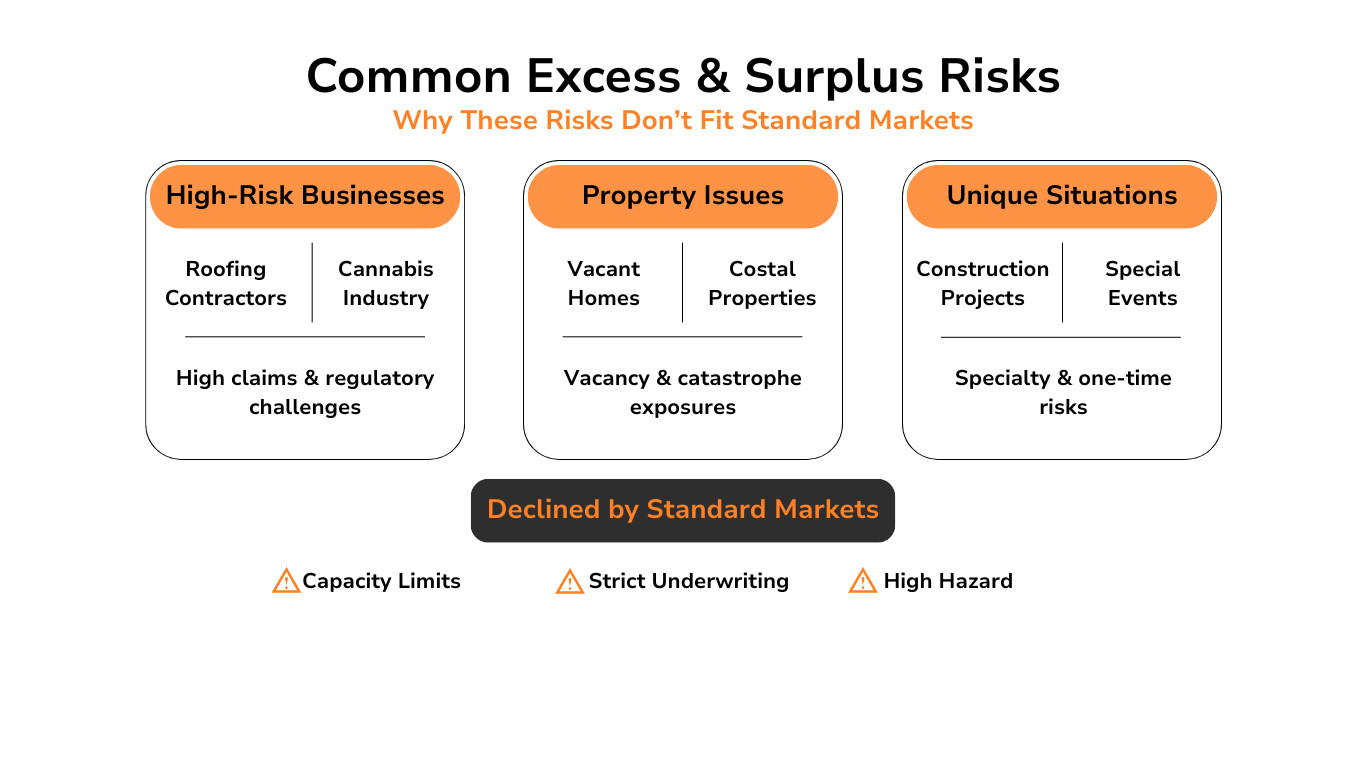

Common Examples of Excess and Surplus Risks

For independent agents, Excess and Surplus (E&S) insurance becomes essential when a client’s exposure falls outside the comfort zone of the standard market.

Understanding why these risks are declined helps you quickly determine when E&S is the right solution.

Certain industries are routinely declined by admitted carriers because of loss frequency, severity, or regulatory complexity.

For example, roofing contractors face elevated general liability claims due to falls, property damage, and employee injury. Many standard carriers simply don’t have the capacity or appetite to absorb that level of exposure, especially if there’s a lapse in coverage or prior claims.

Cannabis businesses are another common E&S placement. Even in states where cannabis is legal, many admitted carriers avoid the sector due to federal regulatory uncertainty and evolving underwriting guidelines.

As a result, cannabis risks are almost always considered hard-to-place and require the flexibility of surplus lines underwriting.

Property Issues

Property-related challenges are one of the most frequent drivers of E&S placements. Vacant dwellings – whether residential or commercial – are typically declined after 30 to 60 days of vacancy. Empty buildings carry higher risks of vandalism, theft, fire, and unnoticed damage, which standard carriers are unwilling to insure.

Similarly, coastal property in hurricane- or flood-prone areas often exceeds the wind or catastrophe limits of admitted carriers. When exposure concentration becomes too high, standard markets pull back, regardless of the property’s condition.

E&S carriers, by contrast, can step in with tailored coverage designed for catastrophe-exposed risks.

Unique or Complex Situations

Some risks are declined simply because they don’t fit a standard underwriting model. Construction risks, especially for new ventures or specialty trades, often lack the loss history or operational tenure required by standard markets. Special events, high-value collections, or one-off exposures fall into this category as well.

The “Diligent Search” Requirement: A Compliance Checklist

Before a risk can be placed in the Excess and Surplus (E&S) market, most states require agents to clear a regulatory “gate” known as the diligent search. The intent is simple: E&S insurance should be used when coverage is genuinely unavailable in the standard market, not as a shortcut.

For independent agents, understanding how this process works – and how it varies by state – is crucial to staying compliant and audit-ready.

What a Diligent Search Means in Practice

Traditionally, a diligent search involves submitting a risk to admitted carriers and receiving formal declinations before the account can be exported to the surplus lines market.

This is often referred to as the three rejections rule, meaning three admitted carriers must decline the risk. Each rejection should be documented with a declination letter, confirming that the standard market can’t provide coverage.

However, it’s important to note that this requirement is no longer universal. Several states, including Louisiana, Mississippi, Virginia, Wisconsin, and Florida, have eliminated the formal three-declination mandate at the regulatory level.

That said, many carriers, wholesalers, and MGAs may still require evidence of a diligent search as part of their internal underwriting or compliance process. In other words, even when the state doesn’t demand it, the market often does.

Why Documentation Matters

Maintaining clear records protects both you and your agency. Declination letters serve as proof that you acted in good faith and followed required procedures.

During an audit by a state insurance department or surplus lines authority, this documentation can be the difference between a smooth review and a costly compliance issue.

Agents should also be familiar with their state’s export list. If a risk appears on the export list, it may be placed directly with a non-admitted carrier without completing a diligent search. Knowing which risks qualify can significantly speed up the quote-and-bind process.

Here’s a simple compliance checklist:

- Attempt placement with admitted carriers when required

- Collect and retain declination letters

- Confirm whether the risk appears on the export list

- Follow any additional carrier or MGA requirements

- Store documentation for future audits

By treating the diligent search as a standard workflow – not a last-minute hurdle – you can move faster, stay compliant, and confidently place hard-to-find coverage in the E&S market.

Pros and Cons of Surplus Lines for You and Your Clients

Surplus lines coverage is an option when admitted carriers won’t take on a risk. For many clients, it’s the only choice. Agents need to understand the pros and cons of surplus lines coverage so they can address clients’ concerns confidently and set realistic expectations.

Disadvantages

Surplus lines policies often come with trade-offs that clients notice immediately, particularly around cost and protections. Being upfront about these factors builds trust and reduces friction later in the placement process.

- Higher premiums due to flexible, non-filed pricing: Non-admitted carriers are not bound by state-filed rates. This flexibility allows them to price risk accurately, but it often results in higher premiums compared to standard market options – especially for accounts with loss history or hazardous exposures.

- Surplus lines taxes and fees: Unlike admitted policies, surplus lines insurance is subject to state-specific surplus lines taxes and stamping fees. These additional costs can vary widely by state and increase the total premium, so they should be disclosed early in the conversation.

- No state guaranty fund protection: Surplus lines carriers are not backed by the state guaranty fund. If a carrier becomes insolvent, claims are not protected by the state.

- Added administrative burden: Surplus lines placements require extra documentation, including diligent search records, tax filings, and compliance reporting. While manageable, this administrative burden requires consistent workflows and attention to detail.

Advantages

Despite these drawbacks, surplus lines insurance provides capabilities that the standard market simply can’t. In many cases, it’s the only viable path forward for a client.

- Coverage for otherwise uninsurable risks: Surplus lines allow agents to place accounts that admitted carriers decline entirely, keeping clients protected and preventing coverage gaps.

- Customized coverage and manuscript forms: Non-admitted carriers can tailor policy language to fit unique risks, policy exclusions, or operations that don’t align with standard forms.

- Flexible underwriting and broader appetite: Surplus lines underwriters evaluate the full risk profile rather than relying solely on rigid guidelines, making them more open to complex or evolving exposures.

- Higher limits and specialized capacity: Many E&S carriers can offer higher limits and specialized capacity for risks like construction, coastal property, or emerging industries.

While surplus lines insurance may cost more, the alternative is often no coverage at all. For many insureds, E&S coverage is essential to operate, meet lender requirements, and fulfill contractual obligations – making it a practical, and often necessary, solution.

| Pros | Cons |

| Coverage for hard-to-place risks | Higher premiums |

| Customizable policy terms | No state guaranty fund protection |

| Higher capacity limits | Surplus lines taxes and additional fees |

| Flexible underwriting | More administrative paperwork and compliance steps |

How to Access Excess and Surplus Markets

For many independent insurance agents, accessing Excess and Surplus (E&S) markets isn’t challenging because of a lack of expertise – it’s challenging because market access is often slowed by structural friction.

Appointment requirements, shifting carrier appetite, onboarding delays, and manual workflows can stall placements just when a client needs an answer. In today’s hard market, those delays directly threaten client retention, especially for complex Property & Casualty (P&C) risks.

Traditionally, E&S access has been routed through wholesalers. While wholesalers remain an important part of the ecosystem, the experience can vary widely. Some require extensive submissions, repeated underwriting follow-ups, or additional compliance steps before a quote is even considered.

Others have limited carrier options for certain classes like Professional Liability or Commercial Auto, making already hard-to-place risks even more difficult to move forward. For agents working under time pressure, these workflows can quickly become a bottleneck.

Modern agency aggregator platforms offer a different approach. Solutions like FirstConnect are built to reduce friction – not by bypassing underwriting discipline, but by simplifying how agents reach the market.

Instead of waiting weeks for appointments or juggling multiple wholesaler relationships, agents can gain instant carrier access through a single marketplace. This allows for faster submissions, clearer visibility into carrier appetite, and a more efficient path to quote and bind (select carriers) when timing matters.

Moreover, this access model preserves the agent-client relationship. Agents retain ownership of their clients, while the aggregator provides the infrastructure needed to place E&S business without imposing premium volume requirements.

With improved workflows, agents can spend less time on administrative hurdles and more time advising clients on coverage options, claims handling expectations, and risk management.

Here is the access comparison between traditional wholesaler vs. FirstConnect marketplace:

| Traditional Wholesaler/MGA | FirstConnect Marketplace |

| Access dependent on wholesaler relationships | Instant carrier access through a single platform |

| Variable turnaround times | Faster quote workflow |

| May involve fees or commission structures | No access fees |

| Limited carrier appetite per wholesaler | Broad network of E&S carriers |

| Manual, email-heavy processes | Streamlined digital workflow |

| Client relationship varies by arrangement | Agent retains ownership of clients |

Get Free Access to 130+ Top Carriers

Boost Your Agency’s Growth

FAQ

Below are answers to common questions independent agents often receive when discussing E&S insurance with clients. Use these to guide conversations and build clarity around surplus lines placements.

-

Is excess line the same as surplus line?

Yes, the terms “excess line” and “surplus line” are used interchangeably. Both refer to the non-admitted market, commonly grouped under the abbreviation E&S in industry discussions and documentation.

-

Who writes surplus lines insurance?

Surplus lines insurance is written by non-admitted carriers, many of which are subsidiaries of large, financially secure insurers. These carriers are typically rated by A.M. Best, offering insight into their financial strength and claims-paying ability.

-

When is surplus lines coverage necessary?

Excess and surplus lines insurance may be necessary when admitted options are unavailable. The decision ultimately rests with the insured in consultation with their agent and depends on the specific risk, market availability, and any regulatory or lender requirements.