Insurance Quoting Software – Streamline Carrier Access

Every insurance agent knows the frustration. Juggling multiple carrier portals, retyping client information, and waiting hours just to get a handful of quotes. It’s repetitive, slow, and pulls focus away from what really matters: building client relationships and growing your book of business.

That’s why many agents turn to insurance quoting software and digital marketplaces to streamline the quoting experience. With First Connect, agents can generate quotes with select carriers using the Quote Connector, while still having everything they need in one place to access carrier portals, appetite guides, guidelines, and underwriting details.

- Traditional quoting systems often slow down agents. Manual data entry and multiple carrier portals cause delays, errors, and inefficiency, which makes it harder for agents to deliver quick, accurate quotes and stay competitive.

- Insurance quoting software and digital marketplaces helps agents streamline access to multiple carriers from one unified platform.

- First Connect Insurance offers a digital marketplace that includes quoting capabilities for select carriers and lines of business, along with centralized access to carrier portals, appetite information, and underwriting resources.

- Staying updated on carrier guidelines is easier with connected platforms like First Connect Insurance. Tools such as Appetite Finder and centralized carrier resources help agents quickly identify which carriers may be the best fit for a client.

Independent Agent?

Accelerate Your Agency’s Success

The Challenges Faced by Insurance Agents

Insurance agents serve as the critical bridge between clients and carriers. Yet, the day-to-day process of quoting and binding insurance is often time-consuming, fragmented, and frustrating.

Here are a few major challenges insurance agents face:

- Limited access to carriers: Many agents, especially independent ones, struggle to gain access to a wide variety of insurance carriers. Traditional contracting and onboarding processes can take weeks or months. Each carrier has its own portal, documentation, and submission format. Without a centralized insurance quotation system, agents lose valuable time just switching between carrier platforms.

- Inefficient quoting processes: In traditional setups, quoting involves re-entering the same customer data multiple times — once for every carrier. According to one report, people spend an average of 62% of their workday handling mundane, repetitive quoting tasks. This manual process not only slows things down but also increases the risk of errors. Without a reliable insurance quote software, agents can easily miss out on competitive quotes and lose clients to faster competitors.

- Staying updated with industry changes: The insurance market changes rapidly. New regulations, policy updates, and carrier appetite shifts require constant monitoring. Many agents struggle to stay current without automated alerts or centralized communication tools. This lack of visibility can lead to missed opportunities or outdated advice.

- Complex workflows and administrative burden: Managing paperwork, following up on quotes, and tracking renewals are all administrative challenges. Without insurance quoting tools for agents, these tasks consume time that could otherwise be spent building client relationships or growing the business.

First Connect Insurance: Your Solution to Streamlined Insurance Quoting

First Connect Insurance solves these challenges through a digital-first marketplace built for independent agents. The platform offers quoting capabilities for select carriers and lines of business through its Quote Connector tool and gives agents centralized access to carrier portals, underwriting guides, appetite information, and more.

Let’s explore more:

Accessing Multiple Carriers

Traditionally, independent agents have had to secure appointments with each carrier individually—a process that often involves extensive paperwork and lengthy approval cycles. Once onboarded, they still have to work within each carrier’s distinct system.

First Connect changes that dynamic by giving agents centralized access to a large marketplace of carriers without onboarding or subscription fees. Agents can browse appetites, review carrier details, and request appointments from one location.

For select carriers and lines of business, agents can also generate quotes directly through the Quote Connector, while others can be accessed through their carrier portals linked within the platform.

Inefficient Quoting and Binding Processes

Quoting and binding insurance policies traditionally involve repetitive data entry, email chains, and long waiting periods. Each carrier requires unique forms, questions, and pricing logic, which agents must manually navigate.

With First Connect, this entire process is streamlined through insurance quote automation. After entering client information, agents can use the Quote Connector tool to generate quotes with select carriers and lines of business. For other carriers, the platform provides fast access to carrier portals, resources, and appetite information—all in one place.

When a client selects a policy, agents can launch directly into the carrier’s portal from First Connect to complete the bind, with relevant information typically porting over.

Keeping Up With Industry Updates

The insurance industry never stands still. Carriers frequently adjust underwriting guidelines, product offerings, and pricing structures. For independent agents who manage several carriers, staying informed is a constant challenge.

First Connect Insurance updates carrier information within its system to help agents stay current. Many carrier updates are integrated automatically, while others are reviewed and updated manually as needed. Agents also have access to notifications, product guides, and training materials through the agent portal

This means users of the insurance quotation software don’t have to manually check each carrier’s website for changes. The platform centralizes carrier information in one place, helping agents stay current without needing to check multiple carrier websites.

By keeping agents informed and equipped with the latest insights, First Connect supports better decision-making and stronger client relationships.

How Does First Connect Insurance Work?

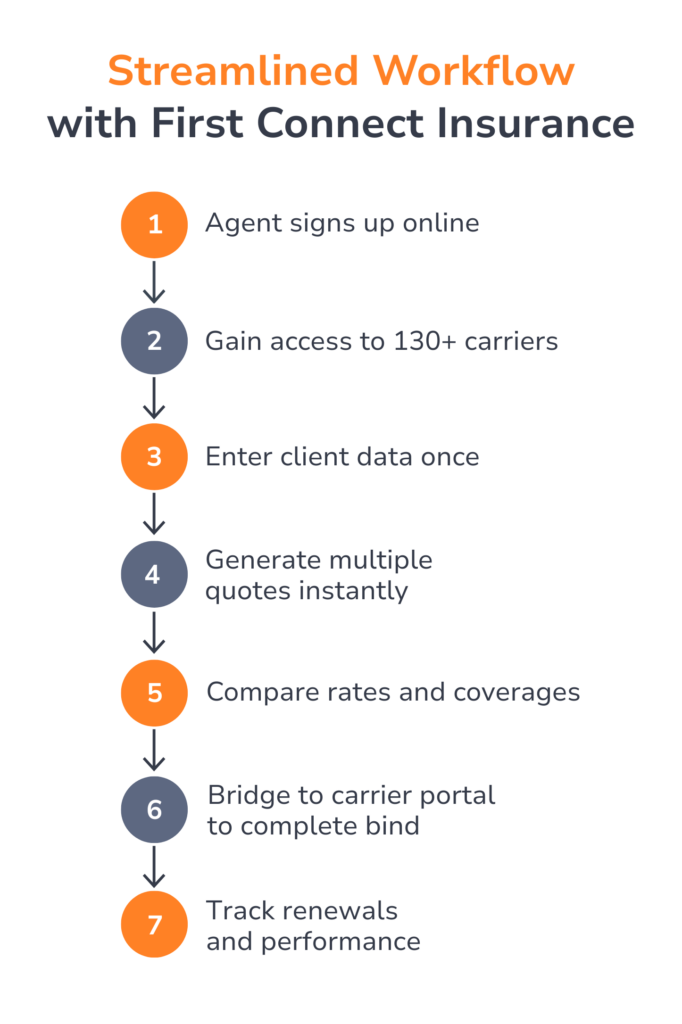

The process to use First Connect is designed to be simple, intuitive, and fast. Here’s how agents can start benefiting from the platform:

- Sign up and verify credentials: Agents register online by submitting basic information, licensing details, and E&O certificates. Onboarding typically takes less than 10 minutes.

- Browse the carrier marketplace: Using the built-in search function, agents can explore available carriers, review their appetites, and request appointments.

- Access quoting tools: Once approved, agents can start using our Quote Connector. The platform’s interface lets users enter client information once and generate quotes with select carriers through the Quote Connector tool, while providing quick access to additional carrier portals for broader market exploration.

- Track, manage, and renew: The agent dashboard provides insights into performance, upcoming renewals, and earnings — ensuring no opportunities are missed.

Access 130+ Top Carriers

Boost Your Agency’s Growth

The Benefits of Using Centralized Insurance Quoting Software

Beyond just saving time, centralized systems such as First Connect Insurance bring a host of strategic advantages:

- Efficiency and speed: With integrated insurance quoting tools for agents, the quoting process for participating carriers becomes significantly faster. Agents can help more clients per day, which directly impacts revenue.

- Improved accuracy: Automation reduces human error. When using insurance quote software, client data is entered once and reused across select carriers, ensuring accuracy and consistency.

- Enhanced client /customer experience: Clients appreciate faster turnaround times and clear comparisons. With insurance quote comparison tools, agents can present clients with transparent, easy-to-understand options — boosting trust and satisfaction.

- Broader market reach: By connecting agents to dozens of carriers, First Connect expands market opportunities. It enables access to new lines such as health insurance quoting solutions, specialty coverage, and regional products.

- Cost savings: There are no onboarding or subscription fees. The centralized platform cuts operational costs while increasing profitability.

- Centralized policy insights: First Connect brings essential policy and commission information together, giving agents a clear view of what they’re writing and where opportunities may exist—without jumping between multiple carrier portals.

Comparative Analysis: Time Saved with a Centralized Quoting Tool

Time is one of the most valuable assets for any insurance agency or agent. However, conventional quoting slows them down with repetitive data entry and long waits.

First Connect Insurance streamlines this by allowing agents to enter client details once and generate quotes with select carriers and lines of business through our Quote Connector comparative rating tool. This reduces duplicate work, cuts down on errors, and speeds up the quoting process— helping agents write more business, faster.

Consider the example:

An independent agent quoting a homeowner’s policy through three separate carriers might spend up to two hours gathering and entering information. With First Connect Insurance’s quoting software, that same process could take just 20 minutes from start to finish.

Multiply that efficiency across several clients a day, and the time savings are substantial – freeing agents to focus on selling, client support, and growth.

Here’s a simple comparison of time saved:

| Task | Traditional Method (Manual) | With First Connect Insurance

(Quote Connector + Centralized Access) |

| Carrier onboarding | 2–4 weeks | 10 minutes |

| Data entry per quote | 20–30 minutes | 5 minutes |

| Generating multiple carrier quotes | 1–2 hours | Instant |

| Binding a policy | 2–3 days | Same day |

| Updating carrier appetites/info | Manual, time-consuming | Automatic |

| Total turnaround time (average) | 2–3 days per client | < 1 hour per client |

Conclusion

In a world where clients expect instant results and seamless digital experiences, insurance agents must leverage technology that keeps them ahead. Insurance quoting software is no longer optional — it’s essential for survival and growth.

First Connect Insurance delivers a unified, easy-to-use platform that simplifies access to carriers and includes quoting capabilities for select carriers – helping agents work faster without overpromising what the platform can do today.

Through its powerful insurance quoting capabilities, it transforms how independent agents work — frees them from manual processes and empowers them to focus on what matters most: helping clients.

With First Connect, agents can quote (to select carriers) faster, write more business, and deliver better service — all while enjoying a smoother, smarter workflow. If you’re ready to elevate your agency’s performance and experience the future of quoting, now is the time to explore First Connect Insurance — where efficiency meets opportunity.