Mile Auto

Now appointing agents in CA and TX!

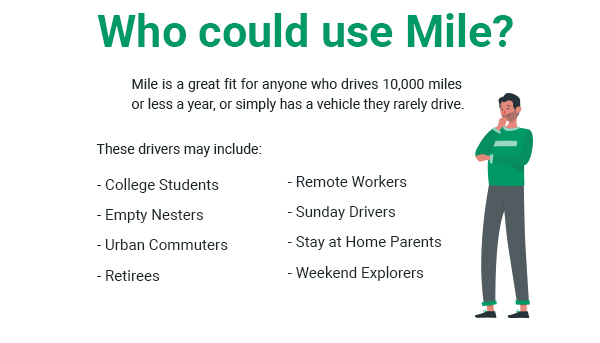

Mile Auto is a pay-per-mile auto insurance company. Low mileage drivers can save money and feel safe about doing so. Customers do not have install a “black box” tracking device. They simply snap a photo of their odometer once a month. Great for remote workers!

Velocity

Commission Changes for Admitted Home Products in North Carolina

Over the past few years, the coastal markets have witnessed a fast-evolving market hardening. These changes have been at historic levels and increased the strain on companies that write in these markets. Factors include weather events, such as Hurricane Ida impacting multiple states, tornadoes, snowstorms and localized severe thunderstorms. Social inflation has also played a role in catapulting loss results as bad actors exploit loopholes in the system. Due to these unfortunate conditions, we have been forced to take difficult actions in every aspect of our business.

Regrettably, this communication serves as notice of a reduction in commissions for our personal lines admitted products. Velocity Risk’s intention has always been to compensate our agents fairly for desirable coastal business, while also managing our capacity responsibly. Please know that we value your partnership through these tough times more than ever, and we remain committed to providing you with an A.M. Best market solution for your agency. Beginning March 1, 2022, all new and renewal personal lines admitted business for the following product will be subject to the new commission structure. The Commission First Connect will be providing will be 8% for new business and 6% for renewals.

Clearcover

Introducing: In-Portal Agent Servicing

Agent servicing just got easier.

We’re putting the power in your hands! We’re excited to announce that servicing is now live in the portal for policies in the following states:

- Alabama

- Georgia

- Indiana

- Kentucky

- Maryland

- Missouri

- Mississippi

- Nebraska

- Pennsylvania

- Virginia

- West Virginia

- Any future states we launch