Changes to workers’ comp and commercial auto

CHANGES TO WORKERS’ COMP AND COMMERCIAL AUTO

Our goal is to effectively evaluate risk and provide competitively priced insurance products. However, in doing so, we occasionally need to adjust our appetite.

After careful consideration, we’ve decided to make changes to workers’ comp and commercial auto to better serve our book.

Workers’ compensation

- A moratorium on binding new business will take effect on July 20, 2022.

- Non-renewals will begin for policies with effective dates ofNovember 1, 2022 and later for the following policies:

- Workers’ comp policies with business locations in CO, KS, and TX

- NCCI Hazard groups F-G

Commercial auto

- Will be closed to new business as of July 20, 2022.

- Non-renewals will begin for policies with effective dates of November 1, 2022 and later.

Please note:

- Only quotes with a bind date prior to July 20, 2022 will be bindable.

- Endorsements added to existing policies and changes that require the policy to be revised and reissued will be reviewed on a case by case basis.

- This closure affects all states and classes of business.

- Our commitment to helping you and your agency succeed remains unchanged. We appreciate your continued partnership.

Thanks,

The NEXT Agency Team

March 2022 Carrier Announcements

Pouch

Pouch is your one stop for light/local mono line commercial auto.

- Policies can be quoted and bound on-line

-

- Most quotes take only minutes

- We accept both credit cards and EFT

- 10% Discount for Paid in Full, 5% for monthly EFT

- Our focus is on light/local commercial auto such as contractors, delivery services, pest control, etc.

- We provide telematics to not only price the customer more accurately, but it allows the business owner to track their fleets when they are not around

-

- Business owners know who is driving safely and who is not

- Business owners can better route their drivers

You can access our quoting site by clicking on this link: https://agent.pouchinsurance.com/Public/AgentLogin

Bookmark this page for future use and I encourage you to try a test quote to see how quick you can complete a quote.

- Pouch Agent Brochure

- How to Reset Your Password

- Arizona Partner Appetite Guide

- Illinois Partner Appetite Guide

- How to Quote Pouch in under 2 Minutes

Pie Insurance

Learn more

Clearcover

Important Product Changes for California

Clearcover Insurance Agency (“Clearcover”) will no longer be writing new business for Response Indemnity Company of California (“RICC”).

As a result of this, effective March 15, 2022, appointed agents will no longer be able to quote or bind any new RICC business through Clearcover’s Agent Portal. Pending quotes with effective dates of March 15, 2022, or later will not be accessible to view or bind.

We are optimistic that we will be back in the California market in some capacity in the near future and look forward to writing new business there again.

February 2022 Carrier Announcements

Mile Auto

Now appointing agents in CA and TX!

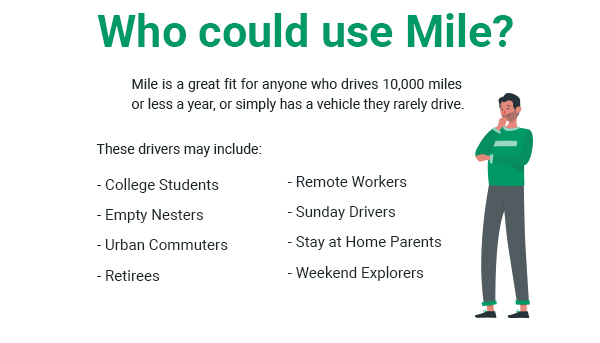

Mile Auto is a pay-per-mile auto insurance company. Low mileage drivers can save money and feel safe about doing so. Customers do not have install a “black box” tracking device. They simply snap a photo of their odometer once a month. Great for remote workers!

Velocity

Commission Changes for Admitted Home Products in North Carolina

Over the past few years, the coastal markets have witnessed a fast-evolving market hardening. These changes have been at historic levels and increased the strain on companies that write in these markets. Factors include weather events, such as Hurricane Ida impacting multiple states, tornadoes, snowstorms and localized severe thunderstorms. Social inflation has also played a role in catapulting loss results as bad actors exploit loopholes in the system. Due to these unfortunate conditions, we have been forced to take difficult actions in every aspect of our business.

Regrettably, this communication serves as notice of a reduction in commissions for our personal lines admitted products. Velocity Risk’s intention has always been to compensate our agents fairly for desirable coastal business, while also managing our capacity responsibly. Please know that we value your partnership through these tough times more than ever, and we remain committed to providing you with an A.M. Best market solution for your agency. Beginning March 1, 2022, all new and renewal personal lines admitted business for the following product will be subject to the new commission structure. The Commission First Connect will be providing will be 8% for new business and 6% for renewals.

Clearcover

Introducing: In-Portal Agent Servicing

Agent servicing just got easier.

We’re putting the power in your hands! We’re excited to announce that servicing is now live in the portal for policies in the following states:

- Alabama

- Georgia

- Indiana

- Kentucky

- Maryland

- Missouri

- Mississippi

- Nebraska

- Pennsylvania

- Virginia

- West Virginia

- Any future states we launch

January 2022 Carrier Announcements

Pie

Pay-as-you-go billing

We heard you when you said your small business clients needed a Pay-as-you-go option to help them manage their workers’ comp costs over time.

We’re excited to partner with Reliable Premium Management to offer Pay-as-you-go as a billing option in the partner portal. Head to our website to learn more about RPM and their Pay-as-you-go solution. If RPM’s Pay-as-you-go services are a good fit for your agency, please call the partner experience team at 855-858-5988 to have the option added to your agency’s account. Once your agency is set up with RPM, you’ll see Pay-as-you-go listed as a billing option when you bind your client’s policies in the partner portal. Questions? Reach out to the partner experience team at 855-858-5988.

Openly

Openly Launches in New Hampshire

Today, I am really excited to announce that Openly is launching its premium homeowners product in New Hampshire. New Hampshire is Openly’s sixteenth state of operation and we are looking forward to bringing our wide and transparent product to your clients! Openly’s quoting portal is now officially live in New Hampshire. If your agency has indicated that they are licensed in NH, agency admins must add NH to their appointed agent. This can be done by using the settings link in the upper right corner of the portal, updating your agency details, and adding licensed agents to your agency. If you use EZLynx, please follow the instructions in the link below to finish setting up your authorization to use Openly through the EZLynx platform: https://openly-inc.elevio.help/en/articles/169

We ask that all of you please provide us with feedback. This can include competitiveness, unique scenarios that you are seeing with the quoting platform or our data that prefills your quotes. Please do not hesitate to reach out to [email protected] or your Openly Business Development team member with this feedback. We will address all questions and comments in our standard timely manner. Thank you again for the partnership and trust! We couldn’t be more pleased to be providing our comprehensive coverage to the state of New Hampshire.

Aegis

Aegis does Ivans Downloads now!! Below is the link for agents to request this.

NEXT

Helping agents like you sell more small business insurance faster is always our goal. One way we do this is by expanding the availability of NEXT coverage.

We just launched coverage for six new auto service and repair classes of business:

- Auto parts store

- Tire shop

- Oil change station

- Auto repair shop

- Auto body shop

- Car wash

The lines of business available for these classes of business include:

- General liability

- Commercial property

- Commercial auto service

This coverage is available in AL, AR, AZ, CO, CT, DC, DE, GA, HI, IL, IN, KY, LA, MD, MI, MO, MS, MT, NC, ND, NE, NH, NM, NV, OH, OK, OR, PA, RI, SC, TN, TX, UT, VA, WI, WV and WY.

Plus, if your customer has a AAA Approved Auto Repair, ASE Blue Seal of Excellence or I-Car Gold Class certification, they can receive a 10% discount on their policy.

For more details about NEXT coverage for auto service and repair businesses, see our coverage guide.

Thanks for partnering with us to help small businesses thrive.

Palomar

New Business Moratorium for Residential and Commercial Flood

Effective January 6, 2022, at 11:00 PM PST, Palomar has implemented a moratorium for new residential and commercial flood business in the following regions:

Residential and Commercial Flood: OR and WA – entire state

Moratorium Guidelines

- Online PASS system will allow new residential flood quotes, but no binds to be processed in affected moratorium areas

- Commercial flood submissions will be accepted, but no binds to be processed in affected moratorium areas

- Renewals will be honored during the moratorium period

- The Company will lift the moratorium at its discretion